Viking has officially filed for its IPO with the United States Securities and Exchanges Commission.

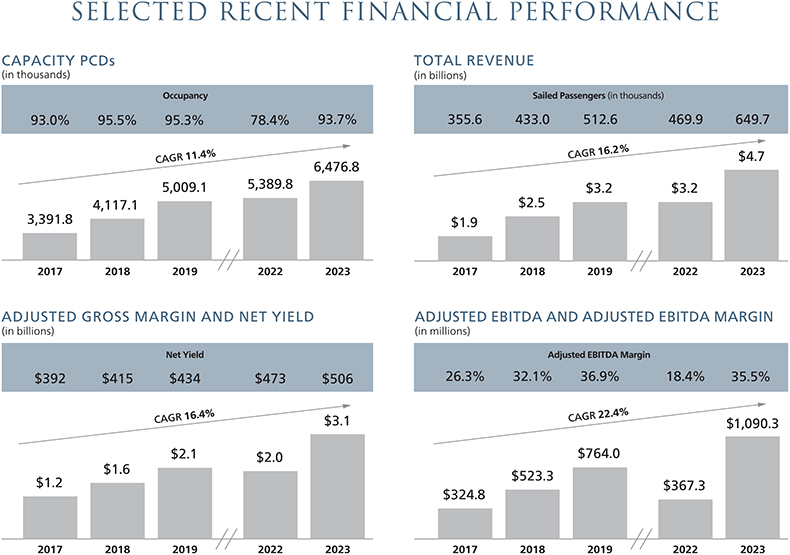

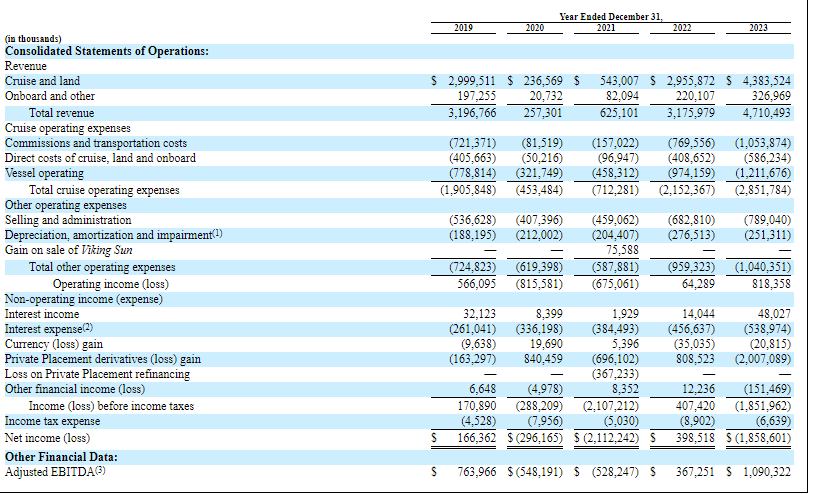

For the year ended December 31, 2023, nearly 650,000 guests traveled with the company and it generated total revenue of $4,710.5 million, a net loss of $1,858.6 million and Adjusted EBITDA of $1,090.3 million.

As of December 31, 2023, the company had $1.5 billion of cash and cash equivalents and $5.4 billion of Total Debt. It also said it had generated industry-leading ROIC of 27.5% for the year ended December 31, 2023, up from 26.1% for the year ended December 31, 2019.

The company said occupancy was 93.7 percent in 2023, up from 78.4 percent in 2022.

“Our payback period for a Longship is on average approximately four to five years based on contributions to operations by a Longship. Our payback period for an ocean ship is on average about five to six years based on contributions to operations by an ocean ship,” the company stated.

“Viking will be the only pure-play luxury public cruise line. In contrast, the large public cruise lines have multiple brands that serve all three categories of the cruise market, with luxury representing only a small percentage of their overall capacity. Our total revenue per passenger was $7,251 for the year ended December 31, 2023. Viking defines the luxury category of the river cruise and ocean cruise markets. We believe these are the most attractive segments of the cruise industry and the global luxury leisure travel market given their growth potential,” Viking said in its filing.