TUI Group today reported its first quarter earnings, including what it said was strong demand for TUI, Marella and Hapag-Lloyd products.

TUI Group’s start to the new financial year 2019 was in line with its own expectations: turnover growth, volume growth, but lower margins, the company said.

“We have paved the way with our investments in hotels and ships, our IT and digital strategy and the acquisition of the Italian digital platform Musement in 2018,” said Fritz Joussen, CEO TUI Group, at the presentation of the Group’s Q1 results on the day of the Annual General Meeting held in Hanover.

The Holiday Experiences segment with Hotels & Resorts, Cruises and Destination Experiences, which accounted for around 70 percent of the Group’s operating result in the completed financial year, again delivered a strong operational performance in the reporting period, the company said. At 111.0 million euros, the segment’s underlying EBITA was down year-on-year (125.9 million euros) on a constant currency basis.

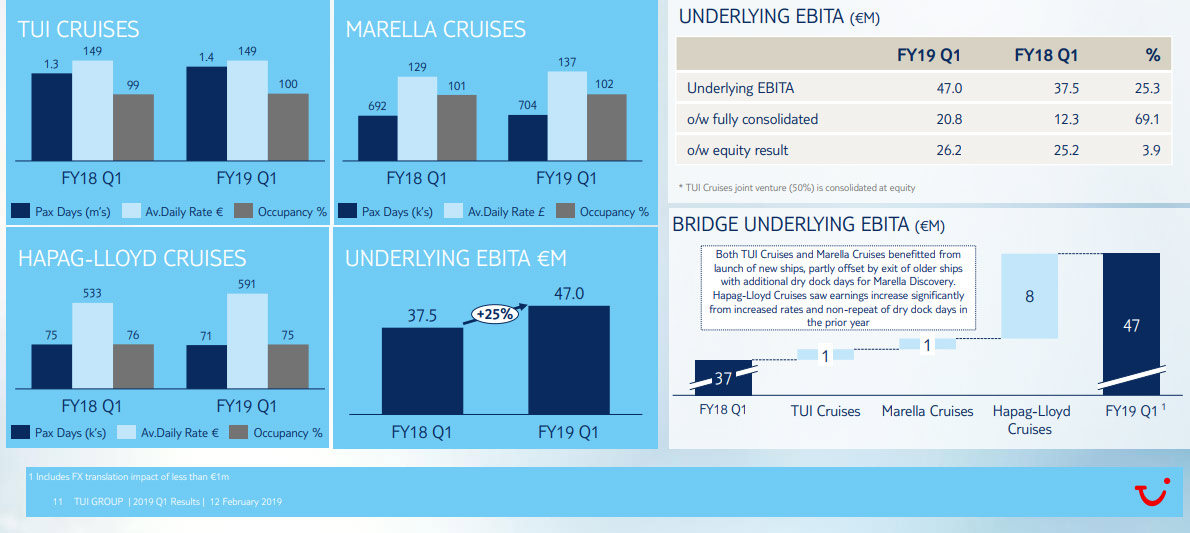

TUI’s cruise division saw increased EBITA driven by increased earnings from Hapag-Lloyd Cruises, while TUI Cruises earnings were up due to the launch of the new Mein Schiff 1, and good performance across the fleet.

Marella also saw a positive increase due to additional capacity in the form of the Marella Explorer.

“Hapag-Lloyd Cruises earnings increased significantly, with increased rates across the fleet and the non-repeat of drydock days in the prior year,” the company said.