TUI Group has announced first half 2020 earnings. The company said January 2020 saw the best bookings month in the company’s history, followed by the COVID-19 crisis.

“The impact on our program and operations has been undeniably acute. For the first time ever in the company’s history, our full program was suspended and alongside many other corporates across the sector State Aid was applied for. As a result of our swift action, TUI was the first business in Germany to receive state support in these exceptional times,” the company said, in its earnings statement.

The first five months (5M) underlying EBIT loss of €343m was up €62m versus prior year excluding digital platforms operational investment, Boeing 737 Max and effect of a one-off

hedging gain, reflecting the strong operational result and start to the year.

H1 Group underlying EBIT loss of €813m was down €512m on prior year as a result of lost contribution in March and costs arising from COVID-19 shutdown, most notably from ineffective hedges, and additionally replacement lease costs relating to the Boeing 737 Max. Total costs in March incurred relating to both COVID-19 measures and Max amounted to €470m.

“The tourism industry has weathered a number of macroeconomic shocks throughout the most recent decades, however the COVID-19 pandemic is unquestionably the greatest crisis

the industry and TUI has ever faced,” the company said.

In March, TUI brought 200,000 customers and 4,000 employees home, and said it had also taken significant crisis measures across the business to reduce cash costs and expenditure to an absolute minimum.

“From capex, to marketing, to rental and leases, all expenditure has been cut or paused. Strict cost discipline, required during these exceptional circumstances, has been a top priority for the business as a whole.

“We have seen a material decline in bookings for Summer 2020 as a result of the travel suspension currently in place,” the company said.

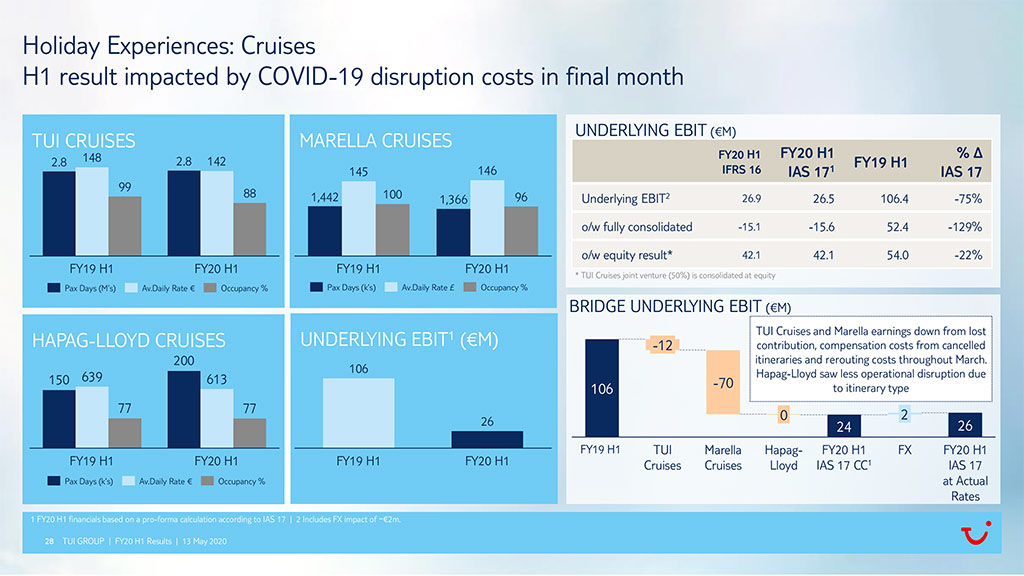

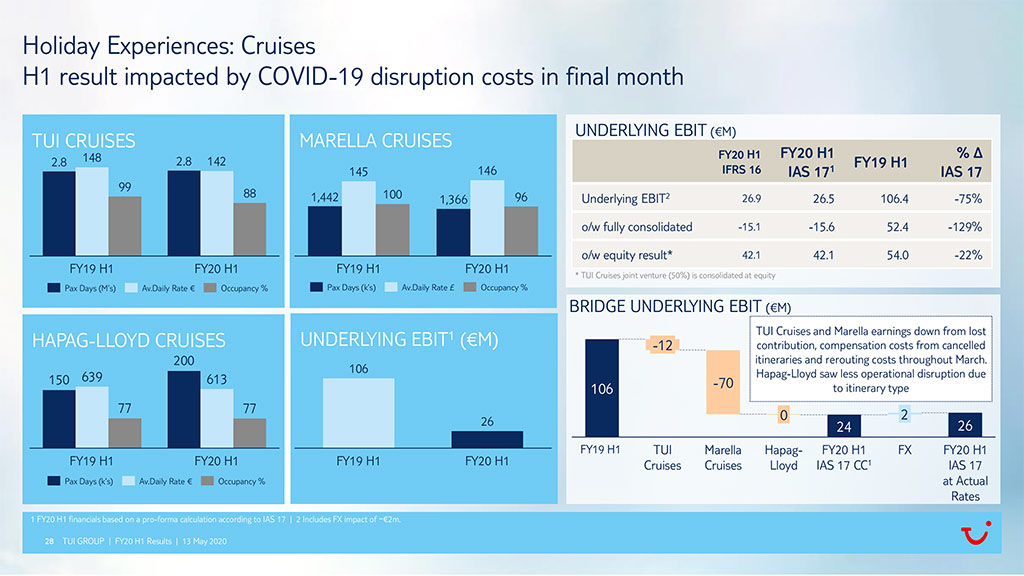

First half cruise earnings €24m were down €82m versus prior year, with TUI Cruises and Marella more notably impacted by lost contribution, compensation costs from cancelled itineraries and rerouting costs throughout March.

Hapag-Lloyd saw less operational disruption due to itinerary type and saw earnings break even in the first half.